General Supply Chain Observations & Updates

General Supply Chain Observations & Updates

The overall economic outlook continues to be quite bleak due to several factors: the Russian invasion of Ukraine, inflation at a 40+ year high, continued strict government regulations, ongoing transportation bottlenecks, and a COVID hangover. Analysts predict between six and 18 months of additional supply chain disruptions.

In January, inflation hit 7.5%, the highest since February 1982. The stock market appears to be in the midst of its largest correction since the initial COVID outbreak in early 2020. The price of coal hit a record high, and crude oil prices have reached their highest level since 2008. The U.S. posted its largest goods trade deficit on record in 2021. At the same time, product availability issues, labor shortages, and high transportation costs all continue unabated.

This quarter’s good news area is steel, where prices of hot-rolled, cold-rolled, galvanized, and plate steel are all down, but availability is a significant concern as suppliers try to catch up with prior orders.

SUGGESTED ACTION:

Backup plans for all aspects of your supply chain, including raw material, consumables, overhead items, and transportation, are more critical than ever.

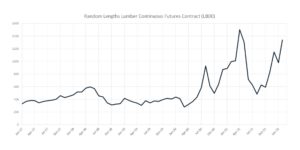

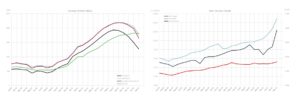

Lumber/Pallets

After appearing to be returning to normal, lumber prices are rising again, and wood pallets (both new lumber and recycled) continue to be supply constrained. Very few pallet suppliers are taking on any new business. Instead, they are simply trying to keep up with the demand of existing customers —which still poses a challenge due to domestic lumber shortages and decreasing imports of pallets that can be recycled.

KEY TAKEAWAY:

Maintaining supply availability is paramount, which means staying in close communication with your supplier(s) to maintain a good relationship. We have seen some cases of suppliers firing their customers to free up capacity for others who are easier to work with or who are willing to pay higher prices. Alternative pallet materials, such as particleboard or plastic (including investigating pallet pooling programs), can still be considered. However, the possibility of more government regulations could lead to alternate material (plastic in particular) costs increasing.

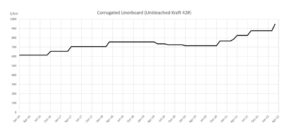

Corrugated

A linerboard increase of $70/ton (8.0%) is likely to be formally announced by the major corrugated producers on March 18 by RISI. The ‘street rate’ for this increase equates to a 14% increase to consumers not currently under contract with favorable pass-through rates.

KEY TAKEAWAY

If possible, buy before this increase hits your transacted prices. Additionally, it is more important than ever to have a transparent indexing (pass-through rate) statement in place with your suppliers to ensure they are not taking undue advantage of the increase.

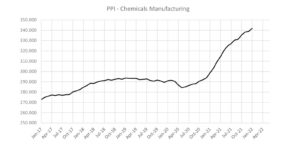

Chemicals and Gases

Raw material shortages and transportation delays continue constraining the chemical sector, but you can expect production to benefit from gradual supply chain improvements this year. At this time,

prices continue to rise, and

predictions show this will be

the trend for 2022.

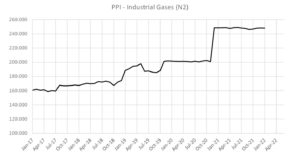

Industrial gas indices remain flat after a significant jump in Q4’20. Industrial gas is an area where we strongly encourage buying now and buying ahead, as the input costs are expected only to go up, and there may be supply disruptions due to current

Industrial gas indices remain flat after a significant jump in Q4’20. Industrial gas is an area where we strongly encourage buying now and buying ahead, as the input costs are expected only to go up, and there may be supply disruptions due to current

geopolitical unrest.

KEY TAKEAWAY & SUGGESTED ACTION:

Keep in close touch with your chemical and gas suppliers and be willing to explore alternate sources and products.

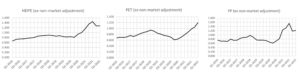

Metals

While prices appear to be coming down for ferrous metals, supply remains tight as evidenced by the graph below. Internationally, President Biden recently agreed to allow the United Kingdom to import 3 million-plus annual tons of steel (free of tariffs) into the United States. Japan and Korea have petitioned for a similar allowance. If they are successful, overall costs may decrease but may have a negative impact on domestic labor.

Product availability continues to be a concern within both the global/import and domestic carbon steel weld fitting and flange categories. Transportation delays and supply chain bottlenecks (both internationally and domestically) continue to impact logistics and the movement of goods from the manufacturers to end-users.

Supplies for copper, aluminum, and nickel are all expected to tighten even more as we continue to watch the developments between Russia and Ukraine. Regarding aluminum, in particular, the price has increased by more than 50% over the past six months—$3,800 per metric ton (an all-time high). Rising energy costs have led to the closure of aluminum plants in China and Europe, which resulted in a loss of roughly 4 million tons of annual capacity. Morgan Stanley estimates aluminum supply could fall 1 million tons short of demand in 2022.

KEY TAKEAWAY:

Supply remains tight; having strong relationships with your suppliers is the best way to increase the likelihood of receiving the material you need in a timely manner.

Plastics

Despite several massive expansions that came online in 2021, resulting in more resin supply than demand, logistical issues and other supply chain issues remain fundamental problems that hinder incremental U.S. resin exports. Delivery and supply chain disruptions have caused increased logistics costs from resin producers and trucking companies throughout the first quarter, according to market updates provided by The Plastic Exchange.

Sourcing for many materials remains tight such as spot resin and prime LLDPE grades for film. Two pending increases from January and February 2022 have yet to be implemented, while resin companies observe the turmoil of global uncertainty (European conflict with Russia and Ukraine, rising oil prices, etc.).

KEY TAKEAWAY:

In the area of film, and similar commodities, aligning your company with suppliers that have sufficient backup capacity and buying power is more important than ever. Some suppliers have had significant disruptions in their ability to provide product over the past couple of years, while the top suppliers have maintained products for their customers.

About the Authors

Travis Cantrell and Patrick Garr are Manufacturing Specialists with Expense Reduction Analysts. They both hold engineering degrees and have over 24 years of collective experience studying complicated client expenditures in Direct Material, Industrial Chemicals/Gases, Packaging Suppliers, and Factory Consumables/MRO. ERA utilizes its in-depth subject-matter expertise to negotiate with suppliers and deliver best-in-class sourcing solutions for their clients.

Travis Cantrell and Patrick Garr are Manufacturing Specialists with Expense Reduction Analysts. They both hold engineering degrees and have over 24 years of collective experience studying complicated client expenditures in Direct Material, Industrial Chemicals/Gases, Packaging Suppliers, and Factory Consumables/MRO. ERA utilizes its in-depth subject-matter expertise to negotiate with suppliers and deliver best-in-class sourcing solutions for their clients.

ERA Manufacturing Specialists – Packaging, Factory Consumables, Chemicals/Industrial Gases, Direct Material