General Supply Chain Observations & Updates

General Supply Chain Observations & Updates

We are hearing and reading a mix of information from economists and suppliers in a wide range of industries. Some state that they expect supply constraints to loosen by the end of the year and prices to plateau. Others tell us that even though some of the commodity indices show price relief, it will still take 6-9 months for those lower prices to work their way down to industrial consumers. The most optimistic outlook is that things will soften a bit by the end of the year, while the pessimists indicate that we may not have relief until late Spring/early Summer of 2022.

Suggested Action:

Maintain open lines of communication with your suppliers regarding lead times, supply shortages, and upcoming price changes. Check-in with them often and make patience and courtesy top priorities—if supply is limited, your suppliers may take care of their “favorite” clients first!

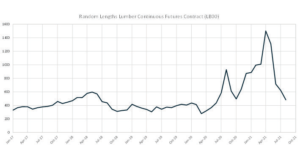

Lumber

Lumber is one of those commodity areas where the indices have significantly decreased off their mid-year peak and lower prices are making their way to consumers in some cases. The best evidence we have of this is that we are seeing new pallet prices are lower than those for recycled pallets in some markets. Recycled lumber, especially for pallets, is still difficult to acquire.

Lumber is one of those commodity areas where the indices have significantly decreased off their mid-year peak and lower prices are making their way to consumers in some cases. The best evidence we have of this is that we are seeing new pallet prices are lower than those for recycled pallets in some markets. Recycled lumber, especially for pallets, is still difficult to acquire.

Key Takeaway & Suggested Action:

Even though lumber prices are finally taking a downturn, recycled pallet prices continue to rise due to labor costs, lack of supply, and transportation cost increases. New lumber pallet prices have returned to earth in some markets. Working with your supplier to decide between new lumber pallets and recycled pallets may be an effective strategy to improve supply as well as mitigate costs.

Corrugated

North American (East open market) unbleached kraft linerboard prices have increased $160/ton (22.3%) over the past 10 months ($50/ton Nov’20, $20/ton Mar’21, $40/ton Apr’21, $50/ton Aug’21). Delays in the supply chain have created even more strain on producers— resulting in reduced material availability. This disruption is stretching lead times from material manufacturers to paper manufacturers, and to end-users. Most suppliers have passed along increases ranging from 35-45% to customers over the past 10 months.

Key Takeaway:

If you are a significant purchaser or corrugated (cartons, sheets, etc.), this is an ideal time to make sure your suppliers have not been taking undue advantage of the increasing market. We have seen cases of suppliers passing along significantly more than 100% of the increases, and in some cases, even violating supply agreements that govern the price change methodology.

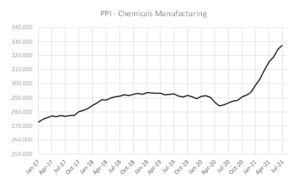

Chemicals and Gases

It may come as a shock that the Texas Freeze and Covid-19 are still being blamed for chemical and gas shortages and high prices, but indeed that is the case. Add in Hurricane Ida, and there appears to be no relief on the horizon for chemical purchasing. Long lead times, force majeure declarations, and high prices still rule the day. This is the case on everything from acrylic acid to canola oil and nearly everything in between. We are not forecasting any relief before mid-2022. Demand for oxygen for hospitals is putting a crunch on the supply of oxygen as well as vessels used to carry other gases, such as nitrogen.

Key Takeaway & Suggested Action:

Chemical and gas manufacturers are still feeling the hit from circumstances from earlier this year and even last year. Keep in close touch with your chemical and gas suppliers and be willing to explore alternate sources and products.

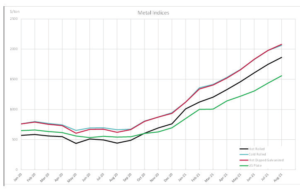

Metals

Nearly every metal index (carbon and non-carbon metals) continues to rise, and there are rumors of price control tactics being used by China. As is the theme of this quarter’s update, we do not anticipate relief before mid-2022, at the earliest.

Key Takeaway:

Key Takeaway:

Steel and metals pricing has increased significantly and continues to go up. Supply remains very tight; having strong relationships with your suppliers is the best way to increase the likelihood of receiving the material you need in a timely manner.

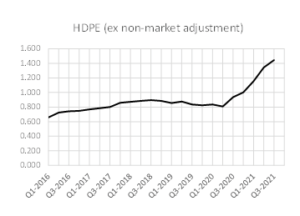

Plastics

Plastics

Polypropylene (PP) remains on force majeure or allocation. Some relief was expected in August, but the recent hurricane that hit the Gulf Coast is impacting supply once again. The outlook for polyethylene (PE) isn’t much better, and we expect both PP and PE markets to remain tight into 2022. Even though some of the pricing indices have leveled off, supply will need to catch up with those price levels before we see relief.

Key Takeaway:

Some plastics items are coming off force majeure now, but supply is still constrained, and hurricane season is upon us, which may further affect production facilities. About the Authors

About the Authors

Patrick Garr and Travis Cantrell are Manufacturing Specialists with Expense Reduction Analysts. They both hold engineering degrees and have over 24 years of collective experience studying complicated client expenditures in Direct Material, Industrial Chemicals/Gases, Packaging Suppliers, and Factory Consumables/MRO. ERA utilizes its in-depth subject-matter expertise to negotiate with suppliers and deliver best-in-class sourcing solutions for their clients.

ERA Manufacturing Specialists – Packaging, Factory Consumables, Chemicals/Industrial Gases, Direct Material