This article is the first in a three-part series detailing best practices, and dispelling common misconceptions, for cost optimization in today’s inflationary market.

Is a recession looming?

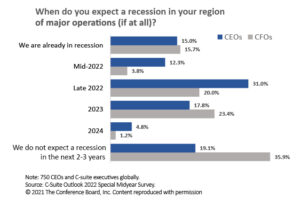

A recent Conference Board survey revealed recession expectations are high, with 75% percent of CEOs globally either anticipating a recession in their primary region of operation within the next 18 months or indicating a recession is already here. Businesses must take measures to ensure their viability and success throughout the challenges ahead.

Focus on supplier cost management and profitability, not just sales.

All the while, business executives are experiencing cost pressures related to supplier price and labor rate increases. According to Supply Chain Dive, Walmart asked for 15% across-the-board price cuts from suppliers at its supplier summit. Other big-box retailers will likely follow suit to improve their declining profitability through supplier negotiations. Middle-market firms selling to larger buyers should expect pushback on future price increases. As a result, we expect to see margin pressure on small and medium-sized businesses.

Companies can only pass along so many price increases to their customers before consumers seek alternate products/suppliers. NPR reports that some manufacturers are quietly shrinking package sizes without lowering prices (“shrinkflation”). This, too, could cause consumer backlash.

All this leads to one conclusion: Companies need alternate ways to maintain profitability.

Economists speculate wages, gasoline, and many other input costs will likely remain high for at least the next year, possibly two. Focusing on productivity and non-wage operating cost optimization will help companies conserve cash and improve margins. Starting these improvements now will ensure your business is well prepared to weather any potential economic downturn and margin squeeze.

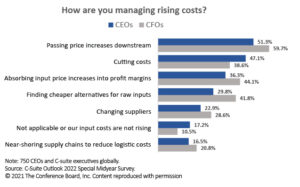

Businesses are deploying various approaches to address rising input costs, with many passing price increases on to customers or simply absorbing the increases. Given the pressure on future price increases, supplier cost optimization will become even more important to maintain healthy margins.

Take four steps now to prepare for a downturn and maximize cost optimization.

Savings opportunities may be found within a company’s current supplier base by using a disciplined approach to cost optimization, including both price and process improvements. Following are four essential steps to get started on your journey to achieve cost savings:

Step 1: Understand your organization’s true spend.

There is a story in your general ledger and supplier spend history. A spend analysis will bring the story to life, providing insight into areas where your organization can make critical improvements. Use multiple lenses in the supplier spend analysis to uncover cost-saving opportunities, process improvements, and associated risks.

Step 2: Get educated fast.

To level the playing field with suppliers, it is essential to understand the supplier’s industry, including what drives their margins. Most companies tend to focus on their strategic or core suppliers. Don’t overlook the tail-spend suppliers (the 80% of suppliers who make up the bottom 20% of the spend). Segment and establish a plan to review and optimize spending by cost category.

Step 3: Establish a pricing review mechanism.

Price increases are now so commonplace that many accept them as “business as usual.” Instead, you should have a process in place to have suppliers explain the cost drivers leading to increases. Be ready to negotiate using an internally developed “should cost” model: Educate yourself with supplier industry dynamics, such as tying increases to industry-standard indexes.

Step 4: Make sure you can measure savings.

As Peter Drucker famously said, “If you can’t measure it, you can’t manage it.” Monitoring adherence to purchase volumes, contract terms, and expected results are paramount to ensure sustainable realized savings.

Now is the time to focus on non-wage operating costs to improve profitability and cash reserves. The next articles in this series will provide insights into supplier cost optimization best practices, as well as things to avoid, as you navigate inflationary headwinds. Every company has its own challenges. Please contact us to discuss how ERA’s cost optimization can benefit your specific situation.

About the Authors

Dileep Kulkarni and Bradley Uhr are Principal Consultants with Expense Reduction Analysts (ERA). They specialize in supplier management and focus on unique customer needs to craft solutions that deliver savings while improving quality and service.