ERA’s quarterly insights regarding market conditions, potential impacts to procurement, and supply chain planning.

General Supply Chain Observations & Updates

One could sum up this quarter’s report in three words: inflation, inflation, inflation. At the end of May 2022, inflation has continued rising at the fastest pace in 40 years (8.6% annually). Energy prices are at all-time highs (up 35% from a year ago), driven by a 60% increase in gas prices over the last year and price increases on several other commodities. Price increases across sectors are starting to hit consumers quite hard. Analysts predict this inflationary market as the norm throughout Q3’2022, potentially longer.

One could sum up this quarter’s report in three words: inflation, inflation, inflation. At the end of May 2022, inflation has continued rising at the fastest pace in 40 years (8.6% annually). Energy prices are at all-time highs (up 35% from a year ago), driven by a 60% increase in gas prices over the last year and price increases on several other commodities. Price increases across sectors are starting to hit consumers quite hard. Analysts predict this inflationary market as the norm throughout Q3’2022, potentially longer.

- Appalachian coal, soybean oil, oats, canola, grapeseed oil, natural gas in the Netherlands, wheat in Paris and Chicago, gasoline, diesel, propane, palm oil, copper, and tin have all notched new highs in 2022. Soybeans, lean hogs, frozen pork bellies, and zinc aren’t far off their records.

- U.S. natural gas prices have jumped >80%

- In the U.S., futures-market chaos has already boosted consumer prices. On January 27, expiring natural-gas futures contracts shot up 46%— the biggest daily gain on record — pausing trade a dozen times that afternoon as prices careened, tripping circuit breakers aimed at maintaining order.

The two areas of optimism we see right now are metals and lumber. Steel, aluminum, and lumber are showing signs of a downward correction.

SUGGESTED ACTION:

Like the last several quarters > backup plans for all aspects of your supply chain, including raw material, consumables, overhead items, and transportation, are more critical than ever.

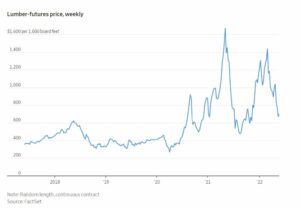

Lumber/Pallets

Lumber prices have generally declined over the past quarter. Lumber futures for July delivery ended in late May at $695.10 per thousand board feet, down 52% from a high in early March. Lumber buyers have slowed orders, and wood is piling up at mills, which are slashing prices, according to Random Lengths. Experts don’t expect lumber prices to fall back to pre-pandemic levels, partly due to problems in Canada’s western forests, where mills have struggled with fire, flood, high-price timber, shipping problems, and duties at the U.S. border. It feels like we have entered a buyer’s market for lumber and new lumber pallets.

KEY TAKEAWAYS:

- New lumber and new lumber pallets: Buy now, and obtain competitive bids from your supply base to look for

opportunities to lower cost. - Recycled lumber/pallets: Supply availability is paramount, which means staying in close communication with your supplier(s) to maintain a good relationship. We continue to see some suppliers “firing” customers to free up capacity for those willing to pay higher prices or are easier to work with. Alternative pallet materials, such as particle board or plastic (including pallet pooling programs), can still be considered. However, the possibility of more government regulations could lead to alternate material (plastic in particular) costs increasing. Recycled lumber pallets, on the other hand, continue to be very difficult to obtain. Pallet core returns are trading at an all-time high, and this situation may not improve until sometime in 2023, at the earliest. Plastic pallets have also seen price pressure in 2022 due to rising oil prices.

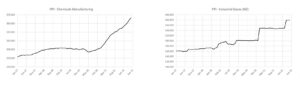

Metals

While steel and aluminum have seen recent declines, other non-ferrous metals continue to be on the rise. Mining companies aren’t spending, and their restraint could keep supplies tight and magnify shortages of raw materials such as copper and zinc. Prices for lithium and cobalt have risen even faster (battery demand), lithium is up over 425% YoY, and cobalt is up over 55% over the same period.

While steel and aluminum have seen recent declines, other non-ferrous metals continue to be on the rise. Mining companies aren’t spending, and their restraint could keep supplies tight and magnify shortages of raw materials such as copper and zinc. Prices for lithium and cobalt have risen even faster (battery demand), lithium is up over 425% YoY, and cobalt is up over 55% over the same period.

KEY TAKEAWAY:

Some buy signals are showing for carbon steel and aluminum, while supply remains tight in nearly every other metal commodity. Having strong relationships with your suppliers is the best way to increase the likelihood of receiving the material you need on time.

Chemicals & Gases

Shortages and constraints are now reaching into every corner of the supply chain, pushing up prices of vital chemicals and materials whose availability was once taken for granted. Unfortunately, there isn’t an end in sight for these high prices. Climbing energy prices are impacting nearly everything, from isopropyl alcohol to sulfuric acid and hydrogen peroxide.

Prices for industrial gases have fluctuated sizably. Instability in market prices has made it more difficult for buyers to anticipate costs and plan accordingly. Argon and hydrogen prices sharply decreased in May, while acetylene and other welding gases have been trending up throughout 2022, according to sources like Producer Price Index and ProcurementIQ.

KEY TAKEAWAY & SUGGESTED ACTION:

Continue strengthening relationships with your suppliers and be willing to investigate alternate products and sources. If you are a periodic buyer of industrial gases, this is a great time to catch a dip in the market on argon and hydrogen.

Corrugated

After the most recent increase in March, both producers and distributors of corrugated are saying they expect the market to be flat for the remainder of 2022. No further increases are on the horizon at this time.

KEY TAKEAWAY:

This could be an excellent time to renegotiate or go out to bid for your corrugated demand. We are seeing more substantial supplier interest in new business in some markets, while others (Midwest and the Rocky Mountains) remain tight.

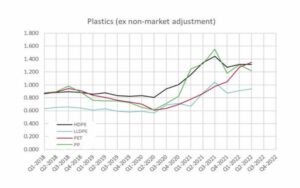

Plastics

We speculate the decline in demand results from high inflation and energy costs impacting downstream consumers. Demand could also slow as the Fed continues manipulating interest rates, reflecting a longer downward trend. An increase in inventories is becoming a concern for U.S. LLDPE suppliers, as the export markets are not providing relief due to the supply constraints plaguing export shipments.

The main driver for the LLDPE market in May was the rise in production costs due to higher energy costs. Reports indicate that production costs rose congruently to the increase in ethylene prices which are forecasted to move higher through the third quarter.

ENERGY MARKETS WILL DICTATE THE FUTURE OF POLYETHYLENE.

Energy prices will be the number one factor putting upward pressure on LLDPE in the immediate future. Elevated natural gas and oil prices strongly correlate with the cost of manufacturing ethylene, not to mention the cost of transporting LLDPE Resin and converted plastic products. All major manufacturers of LLDPE announced an increase in LLDPE Resin prices for June. The increases ranged from $0.06 to $0.09 and manufacturers point to higher input costs as the primary reason for the rise. Watch for hurricane activity in the Atlantic and Gulf that could throw the fragile energy market into a tailspin.

KEY TAKEAWAY:

Shoring up supply should continue to be the number one priority in this area, similar to other materials and commodities.

About the Authors

Travis Cantrell and Patrick Garr are Manufacturing Specialists with Expense Reduction Analysts. They both hold engineering degrees and have over 24 years of collective experience studying complicated client expenditures in Direct Material, Industrial Chemicals/Gases, Packaging Suppliers, and Factory Consumables/MRO. ERA utilizes its in-depth subject-matter expertise to negotiate with suppliers and deliver best-in-class sourcing solutions for their clients.

Travis Cantrell and Patrick Garr are Manufacturing Specialists with Expense Reduction Analysts. They both hold engineering degrees and have over 24 years of collective experience studying complicated client expenditures in Direct Material, Industrial Chemicals/Gases, Packaging Suppliers, and Factory Consumables/MRO. ERA utilizes its in-depth subject-matter expertise to negotiate with suppliers and deliver best-in-class sourcing solutions for their clients.

ERA Manufacturing Specialists – Packaging, Factory Consumables, Chemicals/Industrial Gases, Direct Material