General Supply Chain Observations & Updates

General Supply Chain Observations & Updates

It appears that last quarter’s crystal ball was too fuzzy, and now most experts state the supply chain challenges and problems from the past 12 months are likely to continue for 3-5 years, if not become the new standard. Labor shortages, container shortages, ship capacity, environmental

and business regulations, and continued pandemic fears are ruling the day. This has resulted in astronomical transportation costs, the longest lead times in history, inflation that may exceed any prior cycle, and in some cases, outright panic.

Core CPI is now running at an annualized rate > 6% (a 31-year high). Much of this increase is attributed to gasoline and other areas such as real estate (rents) and global food prices—all of which are at a 10 year high. If there is any silver lining at all in any particular commodity area, it is that resin and plastics prices seem to have leveled off (for now) with capacity coming back online.

Suggested Action:

Back up plans for all aspects of your supply chain, including raw material, consumables, overhead items, and transportation, are more critical than ever.

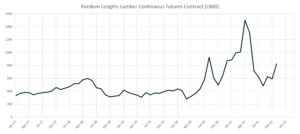

Lumber

After bottoming out in mid-August, lumber prices have been steadily rising again. Additionally, the same types of challenges impacting the economy at large (labor shortages, transportation cost increases, and material availability, or lack thereof) are continuing to plague the lumber and pallet industries.

After bottoming out in mid-August, lumber prices have been steadily rising again. Additionally, the same types of challenges impacting the economy at large (labor shortages, transportation cost increases, and material availability, or lack thereof) are continuing to plague the lumber and pallet industries.

Key Takeaway & Suggested Action:

Obtaining and maintaining supply should be your key objectives. Maintaining strong supplier relationships is very important. A case can be made for considering alternative pallet materials, such as particleboard or plastic (including investigating pallet pooling programs).

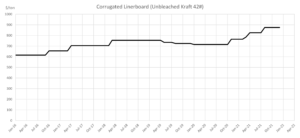

Corrugated

The most recent increase occurred in August, and while one cannot make any promises, there are no current rumors of impending increases. One can expect extended lead times during the Q4 holiday buying season.

Key Takeaway:

Like last quarter, if you are a significant purchaser of corrugated (cartons, sheets, etc.), this is an ideal time to ensure your suppliers have not taken undue advantage of the increasing market. We have seen suppliers passing more than 100% of the increases, and in some cases, even violating supply agreements that govern the price change methodology.

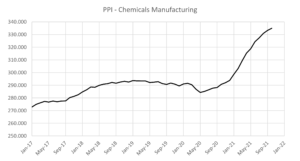

Chemicals and Gases

Chemicals and Gases

The Omicron Coronavirus variant may further disrupt supply chains while impacting demand for chemical markets worldwide. Industrial capacity is under pressure, but supply constraints will lessen, and there is little to suggest that the pandemic has destroyed global industrial capacity. When demand and restrictions lessen, supply constraints should resolve.

Chemicals and polymer industries face significant uncertainties that have emerged or dramatically evolved this year. Some major chemical manufacturers (e.g., BASF, Dow) are beginning to see the first signs of increasing availability for some raw materials. Hopefully, this trend will continue, supply/demand will stabilize, and prices will revert to normal.

In other supplier news, Mitsubishi plans to implement a flatter organization structure by Q2 2022 and exit the petchem market by 2025. As a potential replacement area, they intend to increase their industrial gases market share, mainly in the U.S. and Europe.

The bottom line is that the chemicals industry needs to be ready for anything—proactive inventory management is crucial.

Key Takeaway & Suggested Action:

Keep in close touch with your chemical and gas suppliers and be willing to explore alternate sources and products.

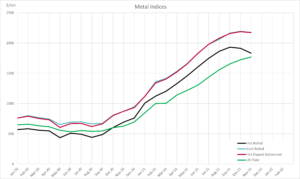

Metals

Over the past quarter, we are finally seeing some signs of flattening or easing in the carbon-steel markets, especially hot-rolled coil steel (HRC). U.S. Steelmakers are beginning to face pressures from European exporters, in addition to added capacity coming online in the U.S. On the other hand, stainless and other alloy metals continue to face very tight supply and logistical bottlenecks, resulting in record prices and long lead times.

Key Takeaway:

Supply remains tight; having strong relationships with your suppliers is the best way to increase the likelihood of receiving the material you need in a timely manner.

Plastics

Plastics

A mix of factors continues to complicate the outlook for plastics. October contract pricing for polyethylene (PE) was down as capacity was restored. At the same time, inflation and energy costs are moving in the wrong direction, while even more capacity is being brought online through a joint venture of ExxonMobil and Sabic. Further adding to PE pressures, as the global economy continues to expand at levels not seen in more than a decade, the demand for PE is expected to remain strong through 2022.

Key Takeaway:

Like most areas, staying in touch with your suppliers regarding material availability and pricing is essential. Forecasting your needs and sharing those forecasts with suppliers can be helpful.

About the Authors

Travis Cantrell and Patrick Garr are Manufacturing Specialists with Expense Reduction Analysts. They both hold engineering degrees and have over 24 years of collective experience studying complicated client expenditures in Direct Material, Industrial Chemicals/Gases, Packaging Suppliers, and Factory Consumables/MRO. ERA utilizes its in-depth subject-matter expertise to negotiate with suppliers and deliver best-in-class sourcing solutions for their clients.

Travis Cantrell and Patrick Garr are Manufacturing Specialists with Expense Reduction Analysts. They both hold engineering degrees and have over 24 years of collective experience studying complicated client expenditures in Direct Material, Industrial Chemicals/Gases, Packaging Suppliers, and Factory Consumables/MRO. ERA utilizes its in-depth subject-matter expertise to negotiate with suppliers and deliver best-in-class sourcing solutions for their clients.

ERA Manufacturing Specialists – Packaging, Factory Consumables, Chemicals/Industrial Gases, Direct Material