ERA’s quarterly insights regarding market conditions, potential impacts on procurement, and supply chain planning.

General Supply Chain Observations & Updates

Seventy-one percent of global companies list raw material costs as their number one supply chain threat concern in 2023. Geopolitical tensions continue to be a source of strain on supply chains. The U.S. Dollar continues to decline from its 20-year peak in Q3 2022 as weak data reinforced the likelihood of an upcoming U.S. recession. All of this lends to the importance and necessity of organizing a capable, agile, and forward-looking supply chain strategy.

Supply Chain & Freight

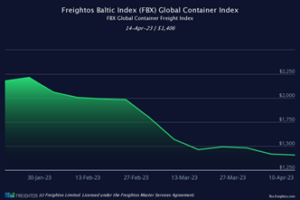

Major retailers like Nike and Adidas report that they are still coping with inventory surpluses built up over Q1 of last year, with other importers taking drastic inventory-reduction measures in response. The longer inventories remain high, the longer new orders, ocean volumes, and freight rates will remain deflated.

The truckload linehaul index declined 0.4% in February and another 0.6% in March. The larger contract market should continue to adjust in the downward direction. The trend change for 2023 shows that freight has been moving to L.T.L. instead of other modes, but a rebalancing is on the way. Fuel surcharge rates decreased steadily during the first quarter of 2023.

Major parcel shippers imposed a 6.9% general rate increase (GRI) for 2023, higher than the past decade’s average of 5%. From an overall supply chain perspective, ERA is seeing a significant shift from suppliers not wanting to be bothered with Requests for Proposal (RFPs) to a newfound hunger for business. The participation rate in our manufacturing-specific RFPs was at an all-time low average of around 30% a year ago, and now it is at least double that mark.

KEY TAKEAWAY: The time is now to buy ahead, push back on suppliers on price, ask for price concessions, and have suppliers compete for your business.

Lumber/Pallets

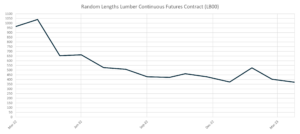

Lumber prices dropped again at the end of March. Economic uncertainty regarding home construction has led to the low volume of lumber sales. U.S. sawmills are holding prices flat, and some are making it known that they are open to counteroffers.

Lumber prices dropped again at the end of March. Economic uncertainty regarding home construction has led to the low volume of lumber sales. U.S. sawmills are holding prices flat, and some are making it known that they are open to counteroffers.

The market is softening for pallets, resulting in a decrease in pallet prices. However, pallet prices will most likely not return to pre-COVID levels. Pallet providers are still constrained by staffing and (recycled) material availability issues.

KEY TAKEAWAYS: We suggest avoiding a cherry-picking approach with your pallet suppliers. Work to foster a relationship with your pallet supplier(s) and develop a long-term pallet strategy.

Chemicals & Gases

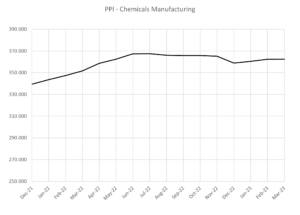

Oversupply continues to be an issue for chemical manufacturers, as well as volatile and high-cost raw materials. Sales are down 2.1% Y/Y, while inventories are 10.0% Y/Y higher. Hydrogen prices fell by 30% during the first quarter, citing low demand and low ammonia consumption rates. The production trend for chemicals is expected to remain flat throughout 2023.

KEY TAKEAWAY: As mentioned in the general observations above, the time is now for pushing back on prices or having suppliers compete for business.

Plastics

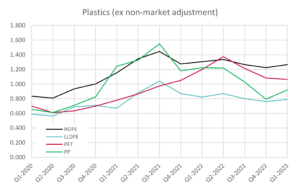

Price drops are expected for polypropylene (PP), especially US-based polymer-grade propylene and prime PPP resin. Plentiful availability is leading to these price decreases, with demand staying below average and producers continuing to run their plants at moderate rates. Similarly, reduced demand for High-Density Polyethylene (HDPE) is causing a downward price trend. On the other hand, Linear Low-Density Polyethylene (LLDPE) had two small ($0.03/lb.) increases in Q1.

KEY TAKEAWAY: Communicate often with your suppliers to hold them accountable to current index levels and require documentation for any proposed price increases.

Metals

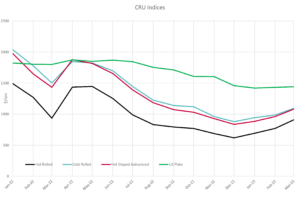

In the U.S. HRC market, another mill increase could be announced soon. Sources say that the coated material market is picking up in the cold-rolled coil and hot-dipped galvanized steel sheet categories, potentially led by restocking and buyers wanting to secure material before prices increase. Lead times for cold-rolled and hot-dipped galvanized coils are estimated to be around eight to ten weeks.

Stainless steel prices had been on the rise through Q1 with increases in the surcharges that are primary components of stainless pricing, but the latest surcharge adjustment in mid-April returns stainless steel to late Q4/early Q1 price levels.

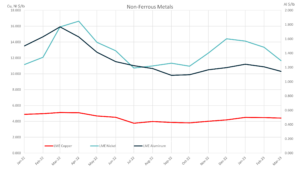

Copper demand is expected to surge to 36.6 million metric tons annually by 2031 to meet the shift to more electric vehicles, solar panels, and other green technologies. Supply is not expected to keep pace, with a lack of new mine resources a primary hurdle. The current copper supply is quite tight, and copper pricing has been the most stable of all significant metals over the past year+.

Copper demand is expected to surge to 36.6 million metric tons annually by 2031 to meet the shift to more electric vehicles, solar panels, and other green technologies. Supply is not expected to keep pace, with a lack of new mine resources a primary hurdle. The current copper supply is quite tight, and copper pricing has been the most stable of all significant metals over the past year+.

After two years of high prices, the price for lithium carbonate, a main component of E.V. batteries, has decreased more than 65% since January. Cobalt and nickel, also used in batteries, have seen price decreases, as well.

KEY TAKEAWAY: Pricing across many metals has leveled out, and increases have begun with more possibly on the way. Buying ahead now and ensuring your suppliers are correctly applying increases (alignment with the indices) are both excellent strategies at this time.

Corrugated

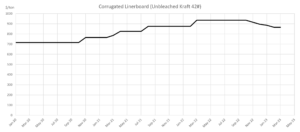

Oversupply and weakening demand led to liner board prices decreasing by more than $70/ton over the past few months, with more decreases anticipated over the coming months. According to the Fibre Box Association, shipments of corrugated declined by 8.4% in Q4 2022 in the U.S. compared to the prior quarter, and this is the largest decline since the financial crisis. Fibre Box also reported that cardboard manufacturer operating rates are at a 14-year low, falling to 80.9% by the end of 2022.

Oversupply and weakening demand led to liner board prices decreasing by more than $70/ton over the past few months, with more decreases anticipated over the coming months. According to the Fibre Box Association, shipments of corrugated declined by 8.4% in Q4 2022 in the U.S. compared to the prior quarter, and this is the largest decline since the financial crisis. Fibre Box also reported that cardboard manufacturer operating rates are at a 14-year low, falling to 80.9% by the end of 2022.

KEY TAKEAWAY: You should be seeing price decreases from your corrugated suppliers. We are contracting at a rate of 1.1% to 1.2% per $10/ton movement, equating to a 7-8% decrease since Nov 2022.

About the Authors

Travis Cantrell and Patrick Garr are Manufacturing Specialists with Expense Reduction Analysts. They both hold engineering degrees and have over 24 years of collective experience studying complicated client expenditures in Direct Material, Industrial Chemicals/Gases, Packaging Suppliers, and Factory Consumables/MRO. ERA utilizes its in-depth subject-matter expertise to negotiate with suppliers and deliver best-in-class sourcing solutions for their clients.

Travis Cantrell and Patrick Garr are Manufacturing Specialists with Expense Reduction Analysts. They both hold engineering degrees and have over 24 years of collective experience studying complicated client expenditures in Direct Material, Industrial Chemicals/Gases, Packaging Suppliers, and Factory Consumables/MRO. ERA utilizes its in-depth subject-matter expertise to negotiate with suppliers and deliver best-in-class sourcing solutions for their clients.

ERA Manufacturing Specialists – Packaging, Factory Consumables, Chemicals/Industrial Gases, Direct Material