ERA’s quarterly insights regarding market conditions, potential impacts on procurement, and supply chain planning.

General Supply Chain Observations & Updates

The housing market has peaked, building permits are declining, home prices are slipping, and inventories are rising. A 2009-type price collapse is not anticipated, but if layoffs continue as predicted, inflation will weigh on consumers and companies. Forecasters are lowering their outlook for the U.S. economy

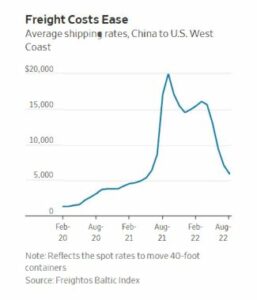

Freight

The cost to ship a 40-foot container declined 60% since January 2022. Major retailers have ended up with too much inventory after importing goods earlier than usual due to worrying about shipping delays and anticipating demand that never materialized. Shipping rates are expected to continue declining for the remainder of 2022 and 2023.

Shipping executives and analysts don’t expect freight rates to return to pre-2020 levels, partly because of higher fuel costs. According to GSC Logistics, ocean carriers continue investing billions in new technologies and fuels to substantially cut carbon emissions on their ships.

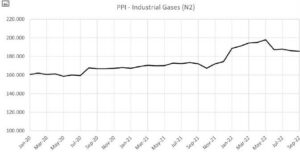

Carbon Dioxide (CO2) supply affecting food production

The nationwide shortage of carbon dioxide continues to affect the operations of U.S. food and beverage giants like Tyson Foods, Kraft Heinz, General Mills, and Butterball. Carbon dioxide is widely used throughout food and beverage industries, from euthanizing animals, chilling and processing meat, adding

The nationwide shortage of carbon dioxide continues to affect the operations of U.S. food and beverage giants like Tyson Foods, Kraft Heinz, General Mills, and Butterball. Carbon dioxide is widely used throughout food and beverage industries, from euthanizing animals, chilling and processing meat, adding

carbonization to soft drinks and beer, and more.

Carbon dioxide supplies have been tight since 2020. CO2 is a byproduct of ethanol and fertilizer production, so when many

Americans stopped driving during the Covid-19 pandemic, less ethanol was produced, and hence less CO2.

Local suppliers with gas to spare are shipping three times farther than normal. One beer company executive said he found a new supplier after his usual carbon dioxide supplier was no longer able to supply the business. Unfortunately, the new supplier was double the cost

KEY TAKEAWAY: As inflation levels continue at or near 40-year highs, which impact the consumer, areas such as housing values and transportation costs are coming down. Food costs continue to increase. None of this will help consumer confidence, and it seems nearly inevitable that the U.S. will enter a full-blown recession if we have not already done so.

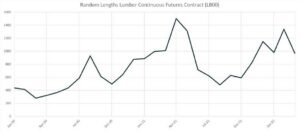

Lumber/Pallets

Chicago lumber futures decreased sharply to the $450 per thousand board feet mark, a level not seen since September 2021 and down almost 70% from their March peak. The housing market is experiencing a significant slowdown amid rising interest rates, and existing home sales fell for a seventh consecutive month in August to their lowest level since May 2020.

However, pallet suppliers still point to labor shortages and short supply, keeping pallet prices high

KEY TAKEAWAYS:

- New lumber and new pallets: Even though lumber pricing has decreased, pallet pricing is still high due to short supply.

New lumber pallets will be easier to find, and pallet suppliers may be more amenable to price negotiation in that category. - Recycled lumber/pallets: Like last quarter, supply availability is paramount, which means staying in close communication

with your supplier(s) to maintain a good relationship.

Metals

Shortly after the Russian invasion of Ukraine in late February, we saw an inflection point (peak) in prices across the global metal exchanges. Three macro-economic issues are driving price declines: hyperinflation and rising interest rates (from the U.S. Federal Reserve), surging energy (especially in Europe), and Covid-19 lock-downs in China (which was already experiencing a softening economy). Additional pressures are occurring on all commodities priced in U.S. dollars, with the U.S. Fed policy resulting in continued strength in USD.

KEY TAKEAWAY: Continue to communicate with your suppliers regarding lead times while holding them accountable for the market decreases and corresponding reduction in your prices.

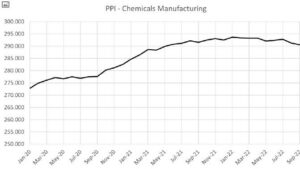

Chemicals & Gases

The chemical industry saw a trend of falling and then stabilizing, before rising again at the end of August, according to ECHEMI.com. Trends throughout the chemical industry closely relate to crude oil.

The chemical industry saw a trend of falling and then stabilizing, before rising again at the end of August, according to ECHEMI.com. Trends throughout the chemical industry closely relate to crude oil.

Tightening power and travel restrictions on the domestic raw material supply side have caused large domestic chemical production sites to restrict transportation, created difficulties in raw material transportation, and delayed the delivery time of raw materials, according to

ECHEMI’s website.

Globally, a decline in factory operating rates and shutdowns caused by various factors are still occurring. However, we expect the supply of raw materials to continue to shrink.

The reduction in supply will continue to spread, and the market inventory will decline again, supporting the surge in chemical raw materials. The August month-end data indicated an industry increase, and we expect the chemical market in October will continue this trend.

KEY TAKEAWAY: Continue to communicate with your suppliers regarding lead times while holding them accountable for the market decreases and corresponding reduction in your prices.

Corrugated

Supply availability has improved over the past couple of months, but trends in the transportation sector continue to magnify supply chain disruptions.

Extremely high demand during the peak-Covid period helped keep producers’ sentiment high in these markets, but as lead times for corrugated boxes have been falling, suppliers have been interpreting this as a softening of the economy as a whole.

Prices are forecasted to increase during the next three years, just as they have quickly risen over the past three years, which has significantly impacted buyers.

Supply chain risk is high in this market, which reveals that suppliers are likely to have difficulty securing the necessary products and equipment for corrugated boxes

Supply chain risk is high in this market, which reveals that suppliers are likely to have difficulty securing the necessary products and equipment for corrugated boxes

KEY TAKEAWAY: Corrugated suppliers are still struggling to keep up with their customers’ demands. Be prepared for long lead times.

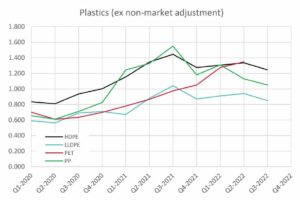

Plastics

The threat of a rail strike in mid-September that would’ve crippled segments of the U.S. economy was averted when a labor agreement, running through 2024,

The threat of a rail strike in mid-September that would’ve crippled segments of the U.S. economy was averted when a labor agreement, running through 2024,

was reached between the largest freight railroads and union leaders. The U.S. plastics market would’ve been severely affected, bringing resin deliveries to a standstill since most plastic resin is delivered to converters via rail.

On the petrochemical front, it is no longer a “seller’s” market in polymers. There are reports of fewer orders and rising inventories.

Over the next few months, high inflation, rising interest rates, and more than plentiful inventories at both the producer and converter levels tell us PE demand is likely to remain weak. The demand weakness remains until buyers see some sort of floor for PE resin prices.

Producers will likely be slower in cutting back on production, so they can make higher margins today instead of waiting until prices are lower. They want to

make as much money/profit today as possible before PE prices fall throughout the end of the year, if they can find buyers.

CDI will implement a non-market adjustment for all PE grades in January 2023. We also expect to see price contractions for PVC, PET, Nylon, PC, and ABS by the end of the year.

KEY TAKEAWAY: Plastic prices are decreasing, so take this opportunity to begin supplier negotiations and bring your prices back to earth.

About the Authors

Travis Cantrell and Patrick Garr are Manufacturing Specialists with Expense Reduction Analysts. They both hold engineering degrees and have over 24 years of collective experience studying complicated client expenditures in Direct Material, Industrial Chemicals/Gases, Packaging Suppliers, and Factory Consumables/MRO. ERA utilizes its in-depth subject-matter expertise to negotiate with suppliers and deliver best-in-class sourcing solutions for their clients.

Travis Cantrell and Patrick Garr are Manufacturing Specialists with Expense Reduction Analysts. They both hold engineering degrees and have over 24 years of collective experience studying complicated client expenditures in Direct Material, Industrial Chemicals/Gases, Packaging Suppliers, and Factory Consumables/MRO. ERA utilizes its in-depth subject-matter expertise to negotiate with suppliers and deliver best-in-class sourcing solutions for their clients.

ERA Manufacturing Specialists – Packaging, Factory Consumables, Chemicals/Industrial Gases, Direct Material