Has your company received a recent treasury review? Now is the perfect time to have one.

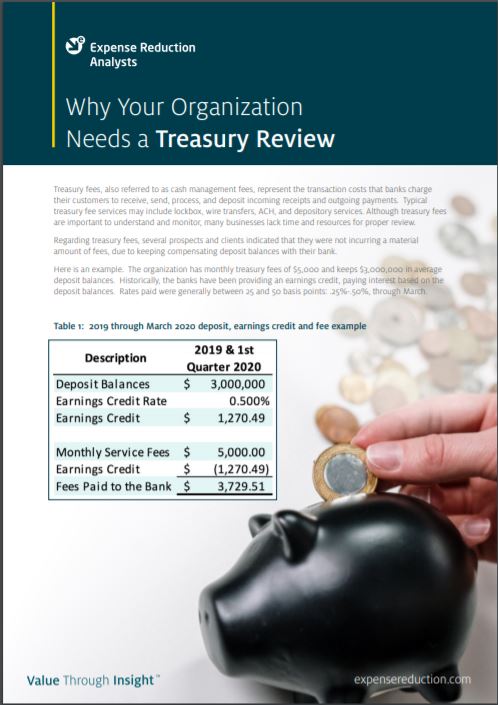

Treasury fees are a critical aspect of your organization’s costs. Also known as cash management fees, treasury fees are essentially transaction costs that banks charge their customers to receive, send, process, and deposit incoming receipts and outgoing payments. Although many organizations may believe treasury fees are under control with deposit balances, the current environment adds complexity to senior leaders.

ERA Principal Consultant Rob Katzman addresses the importance of a treasury review, including:

- Why the earnings credit rate environment is changing

- How deposit balances impact fees paid to your bank

- Why timely action is important to your bottom line

Treasury fees can easily get pushed toward the bottom of a list of competing priorities. However, executive leaders should keep it top of mind to maintain and improve profitability for the future. Download the full article today to gain the competitive advantage your company needs to address treasury fees properly.

Download the full article

Please enter your email address to download this file.

"Some bankers indicate we may even move to a negative earnings credit rate environment, meaning the clients maintaining deposit balances may be assessed a fee to keep deposits in the bank."